Technical analysis - Indicators

2021, May 20

I’ve been learning about technical analysis and how is expected that some scenarios repeat

VWAP

Volume Weighted Average Price (or VWAP) is a trading bechmark that will give you the average price a security has been traded through the day. This value also takes into account the volume and not only the price, therefore if an stock is traded more often at a certain price it will have more weight. For example:

| Price | Volume |

|---|---|

| 10 | 5 |

| 12 | 5 |

| 14 | 10 |

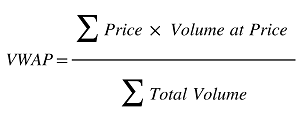

The formula is:

In this scenario the VWAP will be: ((10 * 5) + (12 * 5) + (14 * 10)) / 20 = 12.5

When to use it

The theory here suggest that institutional owners will use the VWAP as reference for long or short trading, and the VWAP will act as a resistance because of the large buys or sells.